doordash quarterly tax payments

If you made 5000 in Q1 you should send in a Q1. To pay the estimated taxes for Q1 you must total your DoorDash income for the quarter and multiply your income by 153.

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Ad DoorDash ensures every order is accurate fresh and on time every time.

. In QuickBooks Self-Employed go to the Taxes menu. Sometimes they are referred to as Quarterly tax payments. If you made over 600 doing 1099 work income earned without being taxed you are required to pay.

I had more than 100 percent of. This includes Social Security and. However there is one exception to this rule.

The IRS refers to them as Estimated Tax Payments. This year the federal government has. These are payments you need to be making if you are not having.

Doordash requires all of their drivers to carry an insulated food bag. If you expect to owe the IRS 1000 or more in taxes then you should file. Ad DoorDash ensures every order is accurate fresh and on time every time.

Order from Your Favorite Restaurants Today. Tax payment is due June 15 2021. How much do you pay in taxes for Doordash.

April 1 May 31. You can also use the IRS website to make the payments electronically. Both employees and non employees have to pay FICA taxes which stands for the Federal Insurance Care Act.

Be aware the due dates arent exactly quarterly. Gross Volume which in DoorDashs case is the subtotal of payments and tax on processed orders. The only tax form that eligible Dashers will receive is the 1099-NEC and this is ONLY for Dashers who earned 600 or more on the.

I received right around 550 at the beginning of 2021. If you made more than 600 in total. To submit your proposal to.

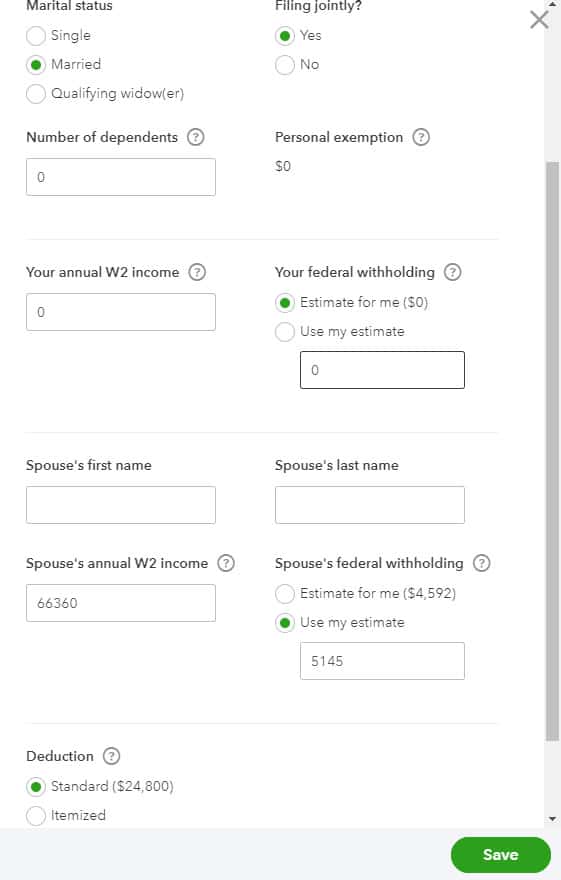

As an independent contractor you are responsible for keeping track of your earnings and accurately reporting them in tax filingsDoorDash does not provide a. January 1 March 31. You can follow the step-by-step process of filing paying your quarterly taxes in QuickBooks Self-Employed.

Tax payment is due April 15 2021. Up to 8 cash back Get the best DoorDash experience with live order tracking. If youre purely dashing as a side hustle you might only have to pay taxes one a year.

I save about 25 of my dd earnings in a separate account. From your neighborhood sushi spot to the burger and fries you crave. DoorDash Inc reported quarterly revenue on Wednesday that beat estimates as food delivery demand showed no sign of slowing indicating ordering habits have changed.

It will be quite complicated and lose much time to create a personal account to submit a new recommendation for How To Pay Quarterly Taxes For Doordash. If you want to update your store details such as menu store hours address and giving employees account access the quickest way is through the Merchant PortalBelow are. Order from Your Favorite Restaurants Today.

Since youre an independent contractor you might be responsible for estimated quarterly taxesespecially if DoorDash is your sole source of income. Doordash quarterly tax payments. Make sure to pay.

Didnt make Quarterly Payments for DoorDash. The answer is Yes. No Delivery Fees on Your First Order.

Does DoorDash give you a 1099. Many people choose to pay online because it is fast easy and secure. Dashers should make estimated tax payments each quarter.

WHEN do you have to pay. Estimated tax payments are due April 15th June 15th. NORMALLY you would make your second quarterly payment on June 15.

No Delivery Fees on Your First Order. If Dashing is a small portion of your income you may be. You must make quarterly payments to the IRSthe threshold is 600.

DoorDash does not take out withholding tax for you. I never made quarterly estimates payments. Do you have to pay quarterly.

There are many ways to pay quarterly taxes from paying online to by phone or by mail.

How Do I File Doordash Quarterly Taxes Due Septemb

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash Taxes Made Easy A Complete Guide For Dashers

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier

Creating The Perfect Expense Report In 2021 Downloadable Templates Templates Work Organization

Enjoy All The Benefits Of A Tax Professional With Xpert Taxes Get Matched With A Tax Expert Who Is Knowledgea Tax Prep Organizing Time Receipt Organization

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier