georgia property tax exemptions for veterans

Real Property Exemptions - Effective July 12008 may apply at anytime prior to April 1st of effective year. Examples of senior property tax exemptions by state.

Wa Vt Nh Me Mt Nd Mn Or Ma Id Wi Ny Sd Ri Wy Mi Ct Pa Ia Nv Nb Oh Nj Ppt Download

Brian Kemp is calling for tax breaks in the first major policy proposals of his reelection campaign.

. Application must be filed electronically through the Georgia Tax Center. 500 a year for taxpayers with homestead exemptions. The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties.

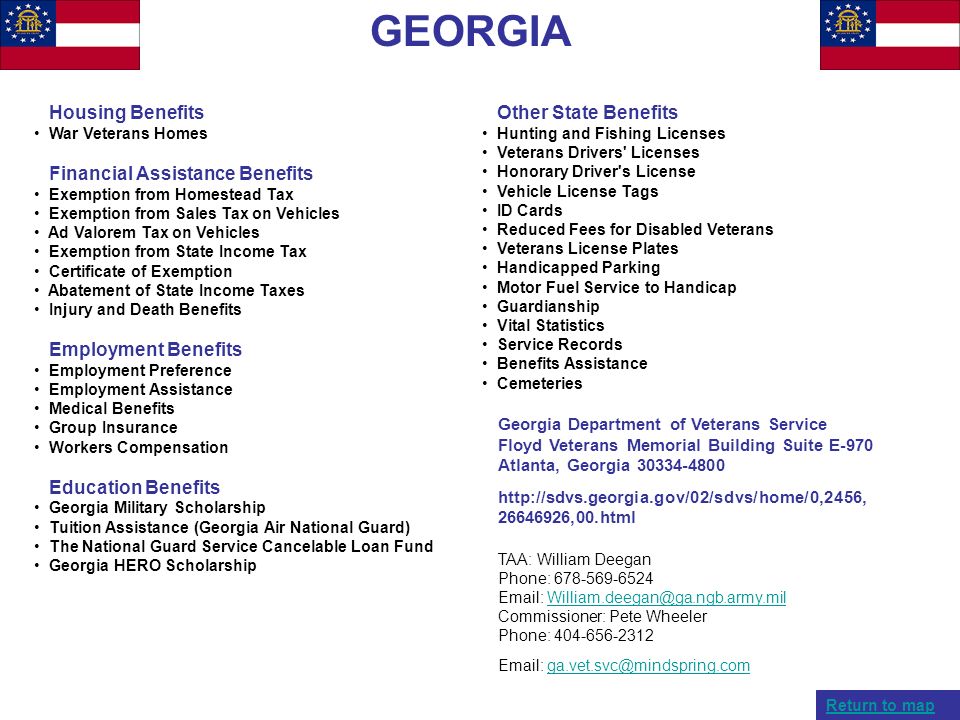

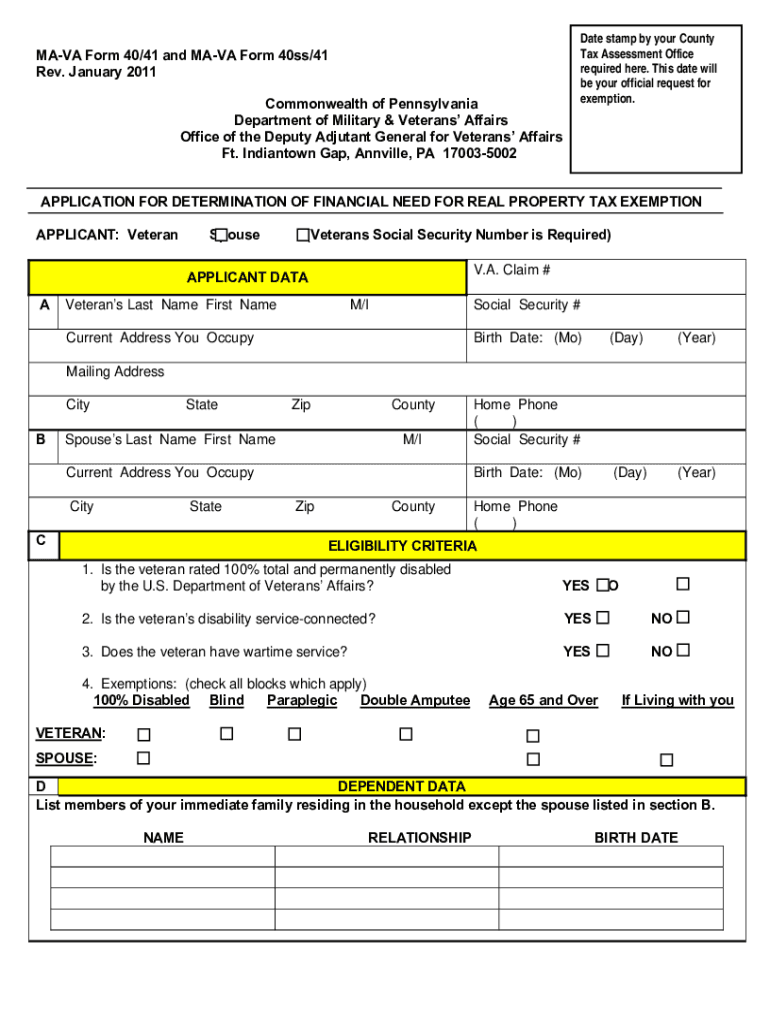

Piedmont Avenue Rockmart Georgia 30153 Phone. Veterans with disabilities may also qualify for property tax exemptions. PA counties and school districts offer different types of tax reliefs.

In order to qualify for homestead exemptions you must provide proof of the following. The median property tax in Fulton County Georgia is 2733 per year for a home worth the median value of 253100. Veterans Property Tax Exemption.

Qualifying veterans can get a 1500 property tax exemption. Requirements for all exemptions. Amanda Lindsey 144 West Avenue Suite A Cedartown Georgia 30125 Phone.

Fulton County collects on average 108 of a propertys assessed fair market value as property tax. Armed forces vets with a total disability and veterans with service-connected disability ratings of 80 or may get an exemption. Special exemptions are available for citizens 62 years of age and older disabled veterans and other disabled residents.

A copy of your Georgia drivers license showing you are a permanent and legal resident of both Cobb County and the state of Georgia. Summary of Georgia Military and Veterans Benefits. Property Tax Homestead Exemptions.

This state offers a full exemption for retirees over 65 when it comes to state property taxes. Mission Statement The mission of the Department of Revenue is to administer the tax laws of the State of Georgia fairly and efficiently in order to promote. If you think you qualify you must apply for exemptions through the Tarrant Appraisal District the exemption will not be granted automatically.

Local Government Services. Additional exemptions based on income and disability. The actual filing of documents is the veterans responsibility.

GDVS personnel will assist veterans in obtaining the necessary documentation for filing. Bankruptcy law imposes limits on the homestead exemption that are not applicable under state law. A Rundown on Veterans Property Tax Exemptions by State.

Contact Information Tax Commissioner. Pursuant to Senate Bill 415 effective November 1 2021 all new applicants for sales tax exemption based on a veterans 100 service-connected disability status are required to register in the Oklahoma Veterans Registry to verify eligibility. Choose from hundreds of different plate designs including veterans colleges special interest groups.

Veterans and surviving spouses previously awarded sales tax exempt status prior to November 1 2021 must register in the. Applications can be filed year round but must be submitted on or before April 1st in order to apply for the current tax year. 770 749-2149 316 N.

Our breakdown of veterans property tax. Unless you live in states with low property taxes such as Alabama Hawaii and West Virginia you may need help covering your tax bills. States With No Property Tax For Seniors After Age 65.

Another 10 states have tax assessment freezes for seniors veterans and disabled homeowners that keep their property taxes from increasing the group says. CA Certificate Service would then charge 7250 for completing the paperwork to obtain a Certificate of Existence even though businesses can easily acquire a. Homestead is the debtors primary residence situated on up to 12 acre in a city and 160 contiguous acres in an unincorporated county.

If your 45-day Georgia temporary permit is due to expire please contact our call center at 404-298-4000 for additional information or visit our office with your bill of sale. The settlement resolves allegations that the company sent deceptive direct mail solicitations to Georgia small business owners offering to assist in obtaining a Certificate of Existence. Qualifying seniors 65 and older can get 50 up to 400 credit against school property tax for their primary residence.

The most common Florida bankruptcy exemptions in 2022 include. Since the property tax rate in Pennsylvania is high you should check if youre eligible for property tax exemption to lower your property tax bill. Most states offer property tax exemptions to seniors veterans widowers and disabled citizens.

Maine joins six states including Connecticut New Jersey and Rhode Island that offer tax freezes for elderly homeowners according to the National Conference of State Legislatures. Alaska also offers money to people who live here which may balance out any additional taxes you have. A homestead exemption is a legal provision that helps to reduce the amount of property taxes on owner-occupied homes.

Instead they exempt a certain portion of the. To be clear property tax exemptions dont let you off the hook completely. Valid Georgia insurance electronically submitted into the Georgia Insurance Database or an insurance binder or declarations page less than 30 days old.

The drivers license must also reflect the property address for which you are claiming the homestead exemption. Fulton County has one of the highest median property taxes in the United States and is ranked 220th of the 3143 counties in order of median property taxes. To receive any Exemptions you must apply in person at the Tax Assessors Office located at 2782 Marietta Hwy Suite 200 Canton GA 30114.

Retirees over 65 get a tax exemption for the first 150000 of their houses value. Property and services are used exclusively in performing a general treatment function when such clinic is a tax exempt entity under the Internal Revenue Code and obtains an exemption determination letter from the Commissioner. Paying your property taxes is no easy feat.

With property values. Senior School Property Tax Relief. If you or your loved one is a veteran you may qualify for a partial or full property tax exemption.

Georgia offers special benefits for Service members Veterans and their Families including property tax exemptions state employment preferences education and tuition assistance free drivers licenses vehicle tags nursing home care for war Veterans as well as hunting and fishing license. Brevard County Property Appraiser - Property Tax Exemptions. Applicants for senior or disability exemptions must apply in person and present copies of the previous years federal and state income tax returns any Social Security Form 1099s proof of age andor proof of 100 percent.

The home must be your primary residence.

Tax Sale Dekalb Tax Commissioner

The Most Popular Veterans Benefit In Every State 24 7 Wall St

Property Tax Exemptions For Disabled Veterans In Michigan And Missouri Homesite Mortgage

Harris County Tx Property Tax Calculator Smartasset

The Most Popular Veterans Benefit In Every State 24 7 Wall St

Talbot County Tax Assessor S Office

Pa Dmva Ma Va 40 41 Ma Va 40ss 41 2011 2022 Fill Out Tax Template Online Us Legal Forms

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/PropertyTaxExemptions-5abfea720b6f4b048a2e654e286d7230.jpeg)

Property Tax Exemptions For Veterans

Baker County Assessor S Office

Colquitt County Tax Assessor S Office

Thomas County Tax Assessor S Office

Evans County Tax Assessor S Office

Maryland Va Home Loan Veteran Home Loans In Maryland Guaranteed Rate

Wa Vt Nh Me Mt Nd Mn Or Ma Id Wi Ny Sd Ri Wy Mi Ct Pa Ia Nv Nb Oh Nj Ppt Download